#Corporate budget planning process update#

Continuous planning and rolling forecasts are becoming widely used methodologies to update plans, budgets and forecasts frequently throughout the year, on a quarterly or even monthly basis. But in today’s more competitive environment, organizations are realizing that plans, budgets and forecasts need to reflect current reality - not the reality of two, three or more quarters ago. Many businesses still base their strategy on annual plans and budgets, which is a management technique developed over a century ago.

#Corporate budget planning process software#

1 Seventy percent of businesses say they rely heavily on spreadsheet reporting, with only 16 percent using on-premise specialist software - and only ten percent using cloud software for planning. Today, cloud-based systems are becoming the standard, providing more flexibility, security and cost savings - helping organizations generate accurate predictions and budgets with fewer errors.īut despite these advancements, businesses are still quite dependent on traditional spreadsheets. With predictive insights drawn automatically from data, companies could identify evolving trends and guide decision making with foresight, not just hindsight. Numerous planning software packages emerged to handle this data complexity, making planning, budgeting and forecasting faster and easier - both for processing and collaboration. The vast amounts of available data for forecasting created a need for more sophisticated software tools to process it. However, Excel programs and spreadsheets were prone to input errors and cumbersome when various departments or individuals needed to collaborate on a report.īy the start of the 2000s, companies gained access to ever-growing operational data sources, as well as information outside corporate transaction systems - such as weather, social sentiment and econometric data. Software applications such as Microsoft Excel became widely popular for financial reporting. The emergence of mainframe computers in the 1960s and personal computers in the 1980s sped up the process. Consulting firms emerged to help companies use these new prediction tools.Īccounting and forecasting were difficult in the early 20th century because they depended on laborious hand-written equations, ledgers and spreadsheets. New types of statistics and statistical analyses were developed that could help business better predict the future. Modern business forecasting began in response to the economic devastation of the Great Depression of the 1930s. Businesses began to regularly use the term “budget” for their finances by the late 1800s. The word “budget” is from the old French word “bougette,” meaning “small purse.” The British government began to use the phrase “open the budget” in the mid-1700s, when the chancellor presented the annual financial statements. However, the definition can be expanded to include all areas of organizational planning including: financial planning and analysis, supply chain planning, sales planning, workforce planning and marketing planning.īasic business accounting practices date as far back as the 1400s, when Venetian investors kept track of their Asian trade expeditions using double-entry bookkeeping, income statements and balance sheets.

The process is usually managed by a chief financial officer (CFO) and the finance department. Forecasts are usually adjusted as new information becomes available. Forecasting takes historical data and current market conditions and then makes predictions as to how much revenue an organization can expect to bring in over the next few months or years.

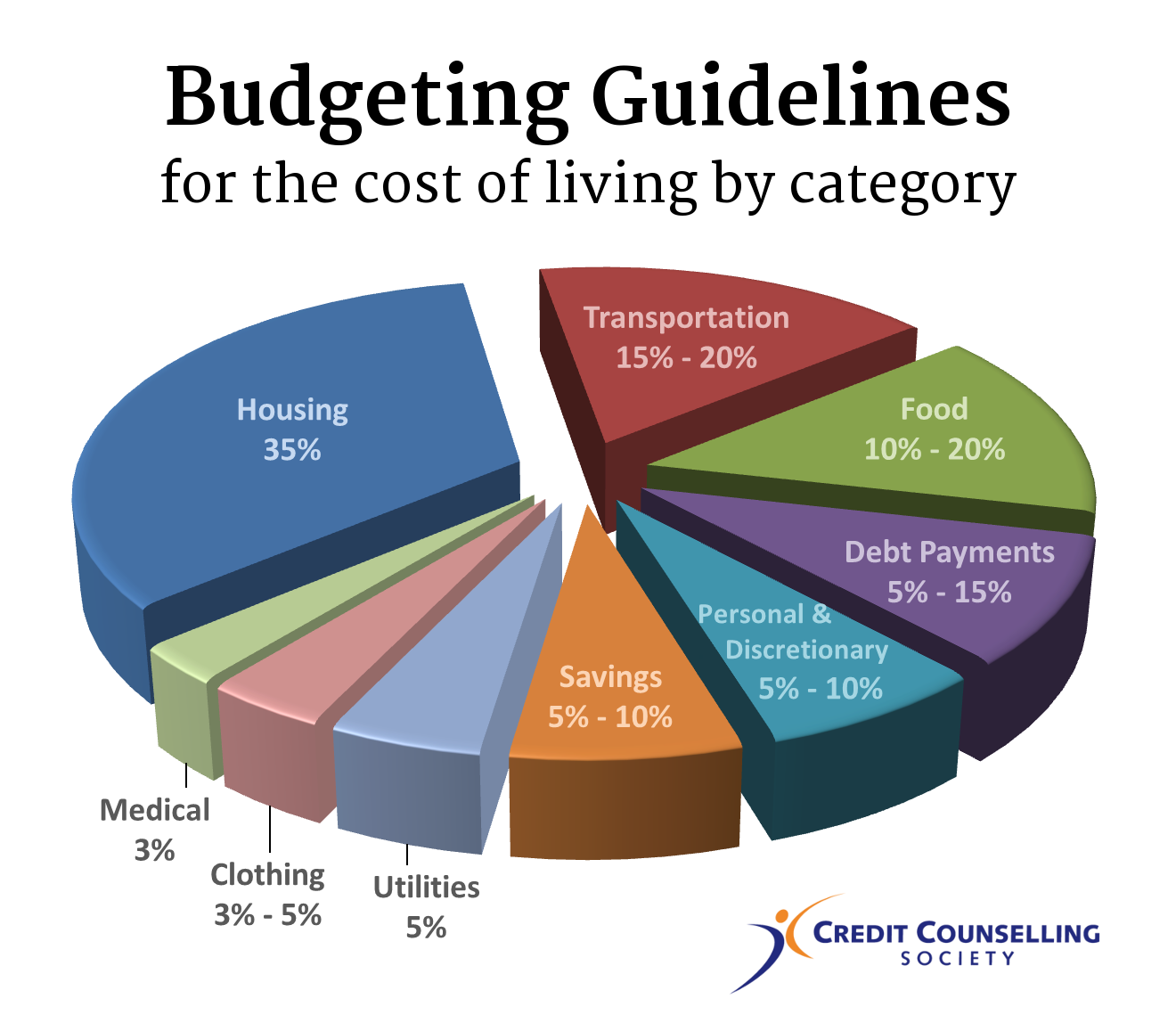

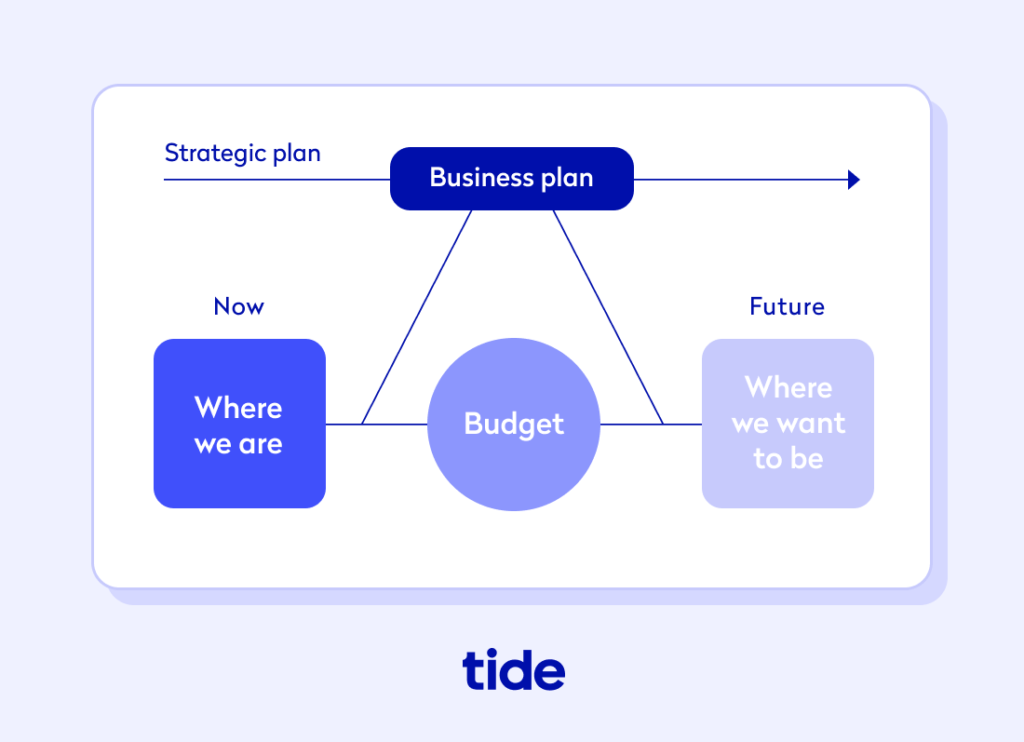

It may adjust the budget depending on actual revenues or compare actual financial statements to determine how close they are to meeting or exceeding the budget. Traditionally, a company will designate a fiscal year and create a budget for the year. Budgeting details how the plan will be carried out month to month and covers items such as revenue, expenses, potential cash flow and debt reduction.Planning provides a framework for a business’ financial objectives - typically for the next three to five years.Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization’s short- and long-term financial goals:

0 kommentar(er)

0 kommentar(er)